Depreciation of building formula

Convention states that residential rental property depreciates by. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset.

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

The process of depreciation starts by having the property placed in servicerental or lease.

. D depreciation n age of building in years rd values are considered as per following table. In our example 100000 minus 5000 equals 95000. This is the depreciable value.

Start by subtracting the residual value of the building from the cost of the building. Depreciation Expense is calculated using the formula given below. The formula for depreciating commercial real estate looks like this.

Therefore Company A would depreciate the machine at. Example the annual depreciation would. Divide step 2 by step 3.

Useful life of the asset. In 275 years the US. Depreciation Expense 4 million 100 million x 25000 0 1000 4.

Annual Depreciation Cost of Assets 100 The annual depreciation is the depreciable cost divided by the assets useful life. For instance if a buyer is selling a property after 10. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense 1250000 cost of property.

1 Straight Line Method. In the Hazza and Co. 80000 5 years 16000 annual depreciation amount.

To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. Depreciation Expense Fixed Assets Cost Salvage Value Useful Life Span. 16 Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the.

Total depreciation FC - SV 5 4 3. Solve for the total depreciation up to the third year. To calculate the depreciation expense using the formula above.

The valuation calculated is exclusive of the cost of land amenities water supply electrical and. Depreciation Expense Formula Depreciation Expense Total PPE. The depreciated value of the property is 1060 ie.

Sum of years n 2 n 1 Sum of years 5 2 5 1 Sum of years 15 years.

Hotel Property Tax Consultant Springville Property Tax Commercial Property

Cash Flow Statement Definition And Meaning Cash Flow Statement Learn Accounting Accounting And Finance

Color Coded Listen Of Basic Accounts For Accounting Accounting Education Accounting Student Bookkeeping Business

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Depreciation Schedule Template Depreciation Schedule Irs Depreciation Schedule Excel Template Dep Schedule Template Marketing Plan Template Schedule Templates

The Cost Approach Reproduction Replacement Cost Reproduction Or Depreciation On Site Property Reproduction Building Costs Heating Cooling System Approach

Assets And Liabilities Spreadsheet Template Balance Sheet Template Spreadsheet Template Balance Sheet

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

The Formula To Achieve Leading Edge Manufacturing Maintenance Practices Facility Management Achievement Facility

How To Calculate Depreciation On Fixed Assets Fixed Asset Math Pictures Economics Lessons

Creative Workflows A 10 Step Guide For Agencies And Brands Step Guide How To Plan Design Management

Safety Checklist Examples Safety Checklist For Office Construction Safety Checklist Excel Building S Safety Checklist Checklist Template Fire Safety Checklist

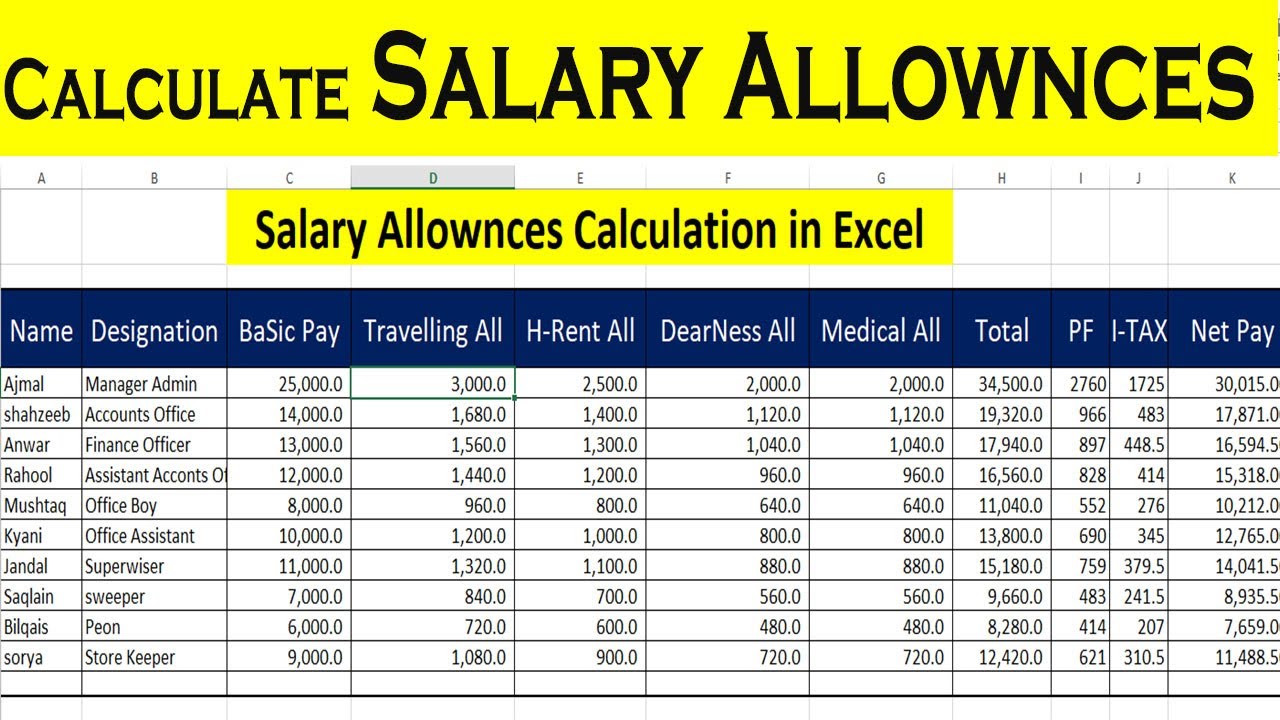

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Learning Centers Tax Deductions Excel

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator